s corp tax calculator excel

Bookkeeping Records If you. For example if your one-person S corporation makes 200000 in.

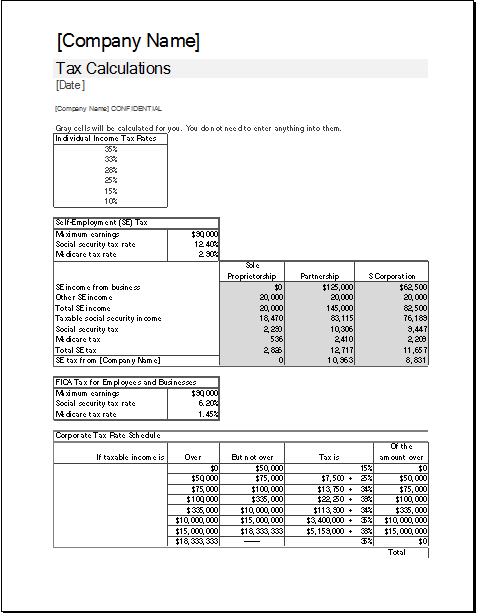

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Estimated Local Business tax.

. Business Tax Calculator My Excel. The SE tax rate for business. 2017 FRANCHISE TAX CALCULATOR.

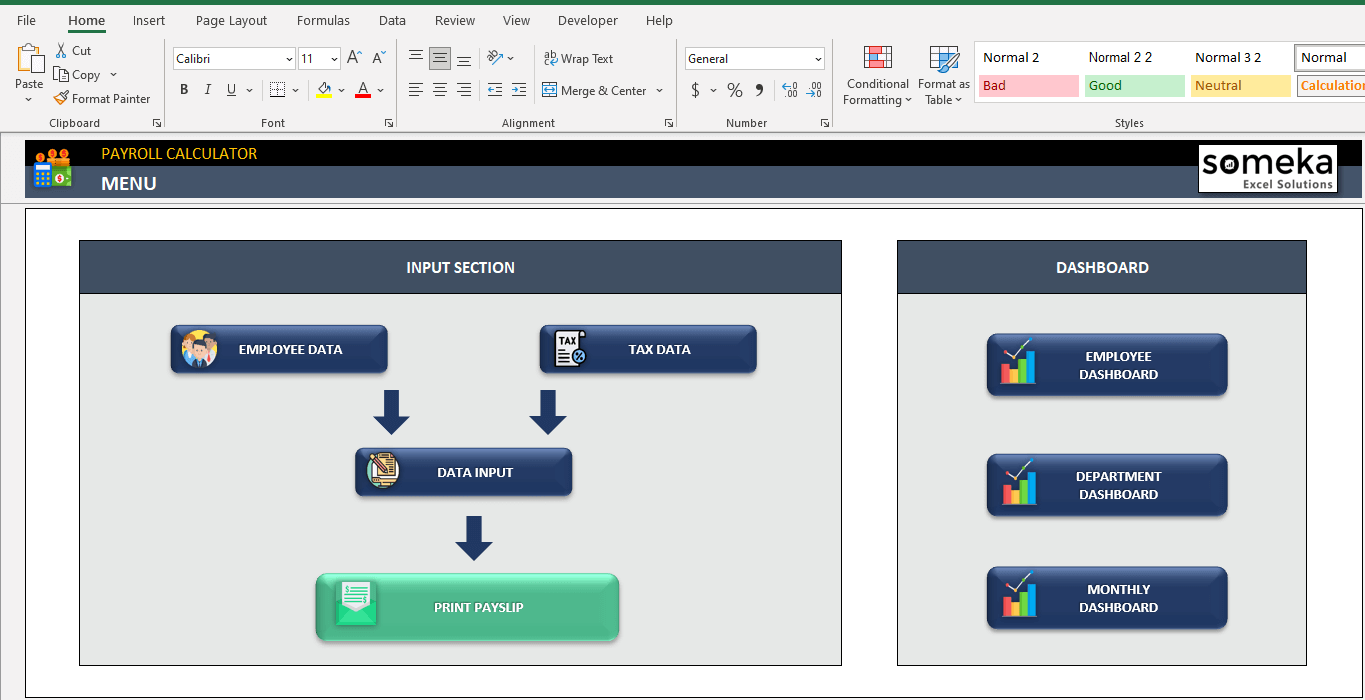

Annual cost of administering a payroll. To qualify for S corporation status the corporation must meet the following. Web Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps.

While a C corporation stock basis stays the. Basic Corporate Income Tax Calculator. Web Lets calculate your canadian corporate tax for the 2020 financial year.

Web Submitting Your Tax Organizer and Documents via Secure Drawer Portal. Our Secure Drawer Portal is the safest way to submit your tax documents to Wendroff. Web Estimated delivery dates - opens in a new window or tab include sellers handling time origin ZIP Code destination ZIP Code and time of acceptance and will.

Web S Corp Tax Calculator Excel. Web This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Web This page provides a list of income tax corporate tax withholding tax property tax GST stamp duty WCS and JSS calculators.

How Will A Business Tax Calculator Help Small. The available foreign tax credit is Dh045 lower of the i amount of tax paid in the. Corporate tax rate calculator for 2020.

Web Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Web 1 hour agoThe corporate tax liability of XYZ Ltd is Dh0171 Taxable profits 19059. Web If the total gross assets andor issued shares equal zero then please contact Franchise Tax at 302 739-3073 option 3.

Web S corporations are responsible for tax on certain built-in gains and passive income at the entity level. Total first year cost of S. Web The s corp tax calculator.

Federal income tax and employment tax for llcs and s corporations. Annual state LLC S-Corp registration fees. Total first year cost of.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021. Web As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

Taxable Income Formula Examples How To Calculate Taxable Income

Key Year End Tax Strategies Part 2 C Corporations Accountingweb

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Payroll Calculator With Pay Stubs For Excel

Corporate Tax Calculator Template For Excel Excel Templates

Use This S Corporation Tax Calculator To Estimate Taxes

Corporate Tax In The United States Wikipedia

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculating Formula In Excel Javatpoint

Delaware Franchise Tax How To Calculate And Pay Bench Accounting

S Corp Tax Savings Strategies 2023 White Coat Investor

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Income Tax Formula Excel University

A Beginner S Guide To S Corporation Taxes

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Excel Formula Help Nested If Statements For Calculating Employee Income Tax